These modular satellites reduce charges and time Drivers want coverage earlier than they get on the street. And space corporations want it earlier than they hurtle metallic projectiles into the sky.

These modular satellites reduce charges and time Drivers want coverage earlier than they get on the street. And space corporations want it earlier than they hurtle metallic projectiles into the sky. providing coverage for area flight could appear to be an insane business resolution. The pool of consumers is tiny, and the possibility is, smartly, astronomical.

The trade gathered $715 million in premiums and paid out $636 million in claims final 12 months, in line with an assurance industry knowledgeable. it is a slim profit, however margins are prevalent to bloat or thin from year to yr. Having a small pool of consumers ability dealing with volatility.

Yet, it is still a constantly profitable company. A small neighborhood of coverage underwriters all over the world have racked up competencies that helps the house industry assess risk and write guidelines.

however a new era of space flight is ushering in drastic changes.

an entire new world of chan ce

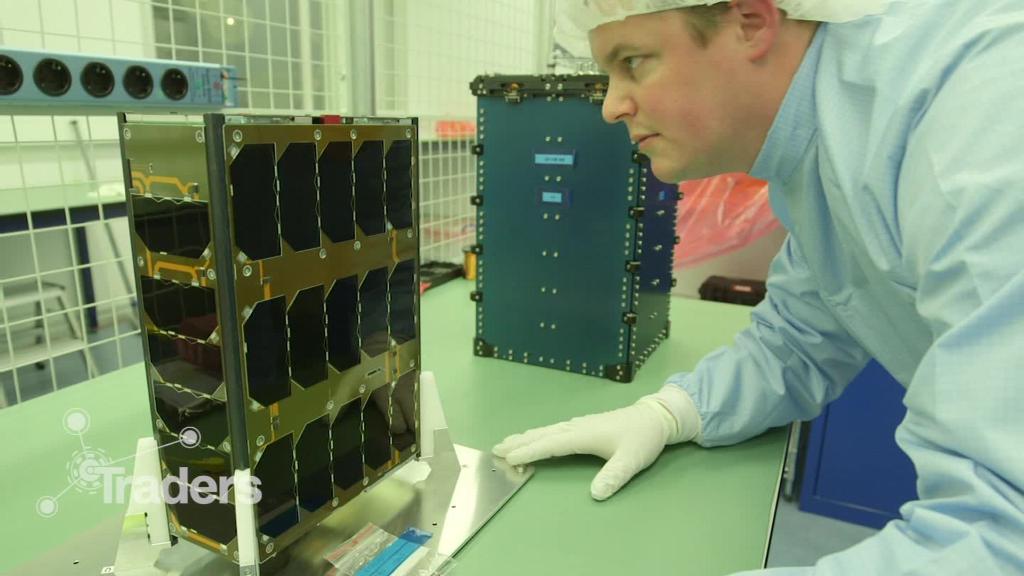

private companies are driving down the costs of launch automobiles and satellites, making space travel greater usual.

coverage for the space trade is available in a lot of types, together with insurance that covers hardware during transportation before launch, insurance that covers launch, and assurance that covers satellites while they may be in orbit.

satellite insurance in particular is set to get a lot more advanced.

Earth's orbit already has an issue with space particles — pieces of junk flying round with out a ability to control them. They encompass discarded rocket boosters dating lower back to the early days of area flight and tiny pieces of shrapnel from a 2007 satellite tv for pc explosion and a 2009 collision.

Low-Earth orbit, or LEO, is probably the most crowded area, and businesses including SpaceX and OneWeb have plans for new satellite tv for pc constellations to be able to put thousands of new gadgets in LEO.

area is big, and collisions are infrequent. however the more stuff it's put in orbit, the better the likelihood of a crash. And the chance does not simply involve objects that are lifeless in orbit. It contains knowledge collisions between active satellites as neatly.

Satellites can cost a couple of million bucks on the low conclusion. but organizations that operate enormous communications satellites in geosynchronus orbit — which will also be worth as a great deal as $1 billion — are especially drawn to conserving their massive investments from spaceborne projectiles.

it really is the place coverage steps in. devoid of it, the satellite tv for pc operators would have to write off the satellite as an entire loss, doubtlessly cutting deep into its base line.

Assessing collision risks is a key piece of what insurers do. just like in each other container of insurance, the better the possibility is, the larger premiums climb.

Chri stopher Gibbs, head of area with AmTrust at the assurance business Lloyd's of London, referred to it's a good concern for underwriters.

"it be whatever thing that we consistently discuss," Gibbs spoke of. And if extra collisions do ensue, "the insurance market will react and premiums will most likely upward push."

The broader area group is basically wanting to handle the collision subject. Many within the industry suggest for more challenging requirements for brand new satellites to ensure they won't turn into a lifeless object in orbit in a while. And other startups and researchers have ambitious plans for gadgets that could be capable of stream or de-orbit one of the crucial junk in space.

Chris Kunstadter, a senior vice chairman at XL Catlin (XL), which currently merged with AXA, stated insurers are "concerned" in a number of these actions. He declined to elaborate.

"everybody recognizes that it be of their activity to improve solutions to the problem," he talked about.

The history of assurance

no longer all insurance for area flight comes from the inner most sector. the U.S. government made the critical decision three a long time in the past to cowl large quantities of collateral hurt in the adventure of a catastrophe throughout a industrial rocket launch.

That assurance would not cowl the cost of a rocket or effective payloads — corporations nevertheless want private insurance for that — nevertheless it does cover the potentially cataclysmic harm if, say, a rocket fails and plummets into an city area.

The executive's resolution to shoulder that chance turned into a video game changer.

Jim Cantrell, the CEO of rocket startup Vector and an early SpaceX govt, credits that determination with making it viable for business space agencies to exist in any respect.

It changed into a win-win, Cantrell observed. house flight changed into now not regarded too harmful for the private sector to get concerned. And it gave the executive an incentive to regulate the launch business to make sure corporations wouldn't build reckless rockets.

fast ahead just a few many years, and the USA is home to one of the most a hit rocket companies on the planet: SpaceX. despite a couple of mishaps, Elon Musk's rocket startup is working a booming company and beating longtime government contractors for launch awards.

assurance underwriters who tackle the other guidelines that rocket companies need for launch are comfortable with SpaceX. And different avid gamers in the launch online game have lengthy song records that make their launches convenient to investigate.

New rockets

The droves of latest house startups amount to a lot of new hazards to determine. every new rocket that enters the market should be meticulously vetted via insurers and federal regulators.

Dozens of latest rocket businesses have poppe d up in fresh years, and a few of them are beginning to enter the market.

Rocket Lab, a US-primarily based assignment with a launch pad in New Zealand, achieved its first successful orbital flight prior this year.

Cantrell's Vector plans to reach orbit before the end of the yr. And Richard Branson's Virgin Orbit and Jeff Bezos's Blue beginning are planning to debut their personal orbital launch expertise within the coming months and years.

"it is where organizations are made or lost during this business company is insuring for his or her loss," Cantrell spoke of.

accurately assessing the chance of rookies is fundamental for insurers, but not many of them will threaten to place a major dent in the industry's income. nearly all of startups, together with Vector, are planning to introduce small, economical rockets so as to launch noticeably low cost satellites.

however with less financial chance comes less reward for insurers.

< p> while the broader world area economic climate is expected to triple over the subsequent two a long time, growing to $1 trillion, the coverage sector grows round 14% — from about $seven hundred million to $800 million, in keeping with a recent file from Morgan Stanley.

0 comments:

Post a Comment